【考点突破】阅读理解:11 金融和理财 专项练--2025中考英语备考(含答案)

文档属性

| 名称 | 【考点突破】阅读理解:11 金融和理财 专项练--2025中考英语备考(含答案) |  | |

| 格式 | docx | ||

| 文件大小 | 285.2KB | ||

| 资源类型 | 试卷 | ||

| 版本资源 | 通用版 | ||

| 科目 | 英语 | ||

| 更新时间 | 2025-01-22 14:55:42 | ||

图片预览

文档简介

【考点突破】阅读理解:11 金融和理财 专项练--2025中考英语备考(含答案)

Learning how to manage money is an important skill for everyone, especially for teenagers. Understanding how to save and spend money can help you make better decisions in the future. Here are some tips on how to manage money.

A budget is a plan that shows how much money you have and how you will spend it.

To create a budget, first you can list all the money you can get, such as pocket money. Then, list all the money you will spend, including food, clothes, books, etc. Make sure you spend less than you can get.

Saving money is important because it helps you prepare for the future. Try to save a part of your money every month. You can save it in a bank account. Saving also helps you build a habit of not spending all your money at once.

Think carefully before you spend your money. Ask yourself if you really need what you are about to buy. It’s easy to spend money on things you don’t need, so think twice before paying. Avoid (避免) impulse buying, which is buying something without planning.

By following these tips, teenagers can learn to manage their money more wisely and better prepare for themselves. The lessons at school should guide the students to practise managing money wisely. But today schools and society had better pay more attention to the topic.

1.What is a budget

A.A plan that tells you how much money you have.

B.A plan that shows how you will spend money.

C.A plan that tells you how much money you have and how you will spend it.

D.A plan for how to spend your money.

2.Why is saving money important

A.It helps you buy more things. B.It allows you to lend money to friends.

C.It prepares you for the future. D.It prevents you from having fun.

3.What should you avoid in order to spend wisely

A.Impulse buying. B.Creating a budget.

C.Saving a part of your money. D.Getting more money.

4.What’s the main idea of the passage

A.How to earn money. B.Money and business.

C.Don’t give your children too much money. D.Money management for teenagers.

5.What does the underlined word “society” mean in Chinese in the last sentence

A.家长 B.社会 C.大众 D.政府

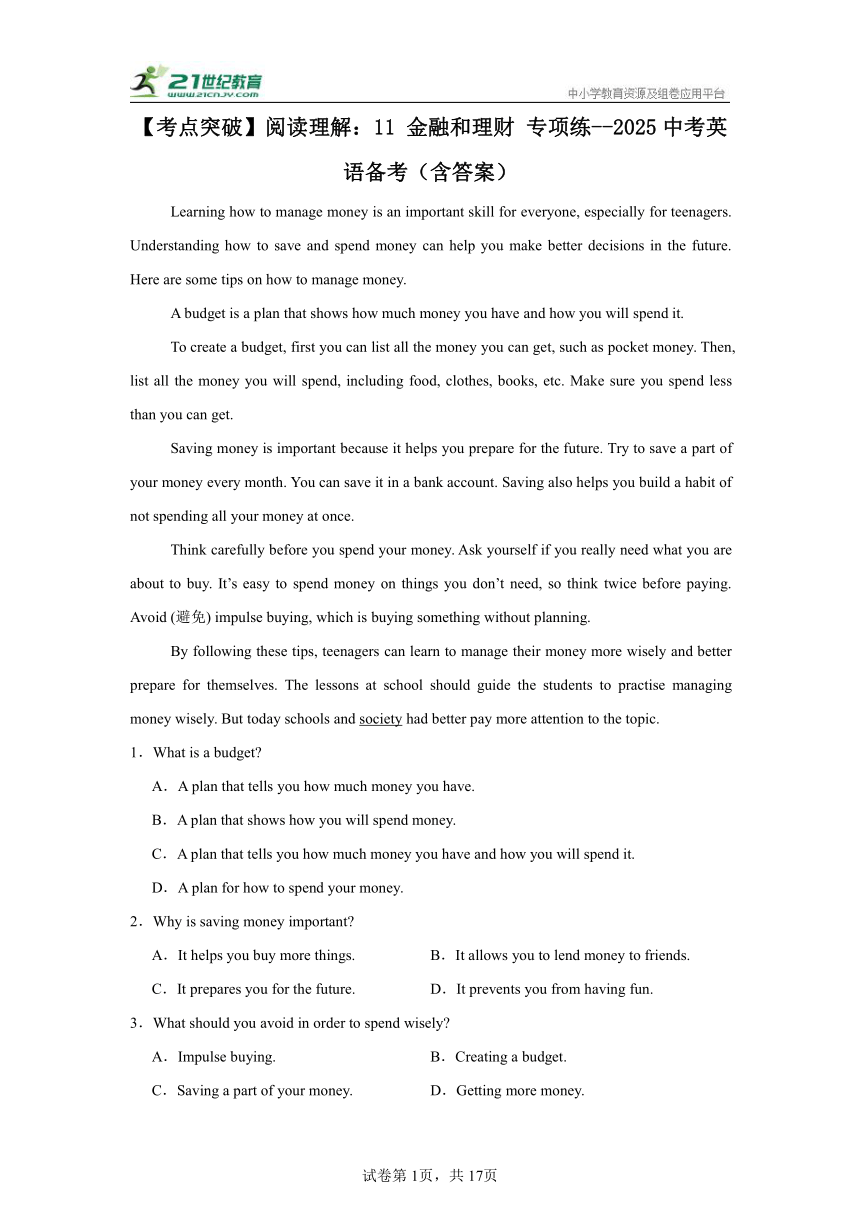

6.What do Peter and Mary spend most of their money on

A.Food. B.Taxes. C.Housing. D.Utilities.

7.Which item is the same percentage (百分比) for Peter and Mary

A.Savings. B.Food. C.Entertainment. D.Insurance.

8.Which of the following statements is TRUE

A.Mary has her own car while Peter doesn’t. B.Peter never saves any money every month.

C.Mary spends less money on food than Peter. D.They spend over 12% of their money on taxes.

Many children first learn the value of money by receiving pocket money. Parents often give their children an amount of money that they may spend as they wish. The aim is to let the children learn from experience at an early age when financial (财务的) mistakes are not very costly.

At first, young children may spend all of their pocket money soon after they receive it. If they do this, they will learn the hard way and then know that spending must be done within a budget. Parents should not offer more money until the next pocket money is given.

Older children may be responsible enough to budget larger costs like those of clothing. The object is to show young people that a budget needs choices between spending and saving.

Many people who have written on the subject say it is not a good idea to pay your child for work around the home. These jobs are a normal part of family life. Paying children to do extra work around the home, however, can be useful. It can even provide an understanding of how a business works.

Pocket money gives children a chance to experience three things they can do with money. They can share it in the form of gifts. They can spend it by buying things they want. Or they can save it.

Saving helps children understand that costly goals require sacrifice (舍弃): you have to cut costs and plan for the future. Requiring children to save part of their pocket money can also open the door to future saving and investing (投资). Many banks offer free savings accounts for young people with small amounts of money.

9.Parents give children pocket money with the aim of ________.

A.letting children learn to deal with money

B.letting children give their pocket money to people in need

C.letting children save more money for their future business

D.letting children spend the pocket money on video games

10.What does the underlined word “It” refer to

A.Paying children for extra work around the home.

B.The housework that children should be paid for.

C.Getting children to do extra work around the home.

D.The amount of money that is paid to children for housework.

11.Which of the following is the writer’s opinion on pocket money

A.Pocket money is given each week or each month by parents.

B.It is necessary for the children to save part of the pocket money.

C.Young children should spend all of their pocket money soon after they receive it.

D.Parents should offer children more money if they spend all soon after they get it.

Every week, Brad’s parents give him $12. It is not a gift. In fact, Brad makes that money himself. Each day, Brad takes out the rubbish, does the dishes and walks the family dog.

The problem is that Brad’s money goes away so quickly. Brad buys hundreds of toys. When he wants to go to the movies with friends, he can never cover a ticket. The money seems to burn a hole (洞) in his pocket.

One day, Brad’s mom says to him, “You should make a budget.”

“What’s that ” asks Brad.

“It’s a plan of how you spend your money. You put the money into different parts for different kinds of things, like toys and snacks. You spend only as much as your budget allows (允许). In that way, you’re sure to have money for different things,” says his dad.

“Sounds great,” says Brad. “Will you help me make one ”

Then, they put the money into different parts for snacks, toys, movies and books. There are also two special parts, one for helping others and the other for Brad’s savings.

From that day on, Brad always has enough money. At the end of the year, he gives away $80 to the old people’s home. Helping those in need makes Brad feel good. He then uses some of his savings to buy a small robot. That makes him feel good, too.

12.Brad makes the money by ________.

A.selling his old toys B.doing housework

C.asking parents for help D.working in a cinema

13.Why does Brad make a budget

A.Because he has too much money.

B.Because he spends money quickly.

C.Because he has a hole in the pocket.

D.Because his pocket is too small for the money.

14.Which is the correct order of the following things

①Brad helps people in need.

②Brad buys a lot of toys.

③Brad puts his money into different parts.

④Brad’s dad tells him what a budget is.

A.①④③② B.②④③① C.②③④① D.④③②①

15.What do we know about Brad’s budget

A.He plans to spend more money on toys.

B.He saves two dollars every week now.

C.He makes the budget without his parents’ help.

D.He gives some money to the old people’s home.

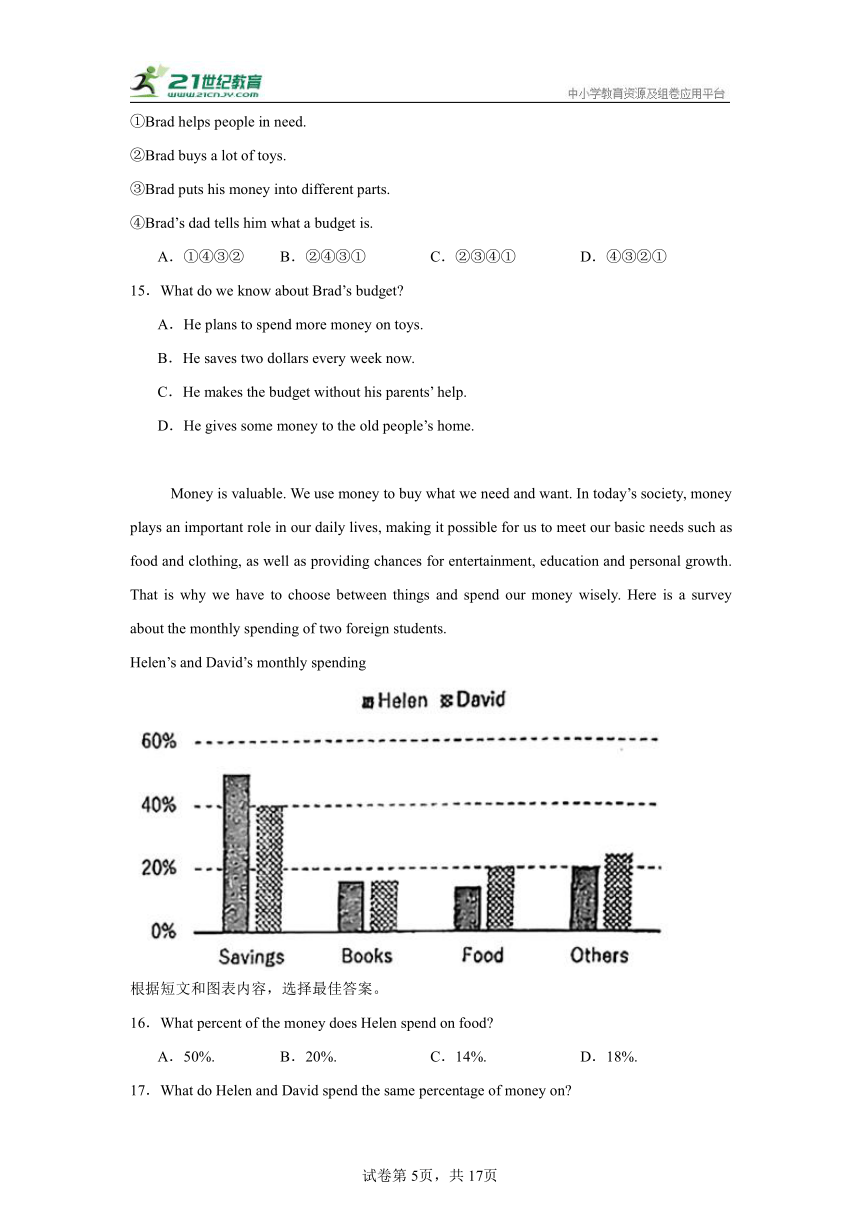

Money is valuable. We use money to buy what we need and want. In today’s society, money plays an important role in our daily lives, making it possible for us to meet our basic needs such as food and clothing, as well as providing chances for entertainment, education and personal growth. That is why we have to choose between things and spend our money wisely. Here is a survey about the monthly spending of two foreign students.

Helen’s and David’s monthly spending

根据短文和图表内容,选择最佳答案。

16.What percent of the money does Helen spend on food

A.50%. B.20%. C.14%. D.18%.

17.What do Helen and David spend the same percentage of money on

A.Others. B.Books. C.Savings. D.Food.

18.What does David pay 20% of his money for

A.Savings. B.Food. C.Books. D.Others.

19.Which of the following does the writer most probably agree with

A.We don’t need to save money. B.Money can buy everything.

C.We should spend our money wisely. D.The more expensive, the better.

20.Where is the passage probably from

A.A storybook. B.A map. C.A music magazine. D.A newspaper.

Try this test to see if you are a typical consumer (典型的消费者) !

1. Are you a fashion (时装) lover Do you go straight to the shops to try the latest styles A.No. Fashion doesn’t interest me. B.I’m interested in fashion but not crazy about it. C. Yes. I always go shopping in order to stay fashionable. 2. If the pair of shoes you like costs over 500 yuan, you’ll _________. A.buy without thinking twice B.think about it and maybe buy later C. forget it; you won’t pay so much for a pair of shoes 3. How do you spend your money A.Save it for later. B.Buy something cultural, like books. C. Go straight to the shops and buy something. 4. Are there any differences between Pepsi and Coca Cola A.No. They are the same. B.Yes, and I only drink one. C. Yes, but I can’t explain the difference. 5. Are you an impulsive (冲动的) consumer A.No, I hardly act without thinking. B.Yes. I love doing things without thinking. C. It depends. Sometimes I am; sometimes I’m not.

Corresponding scores (相应的分数)

Question 1 Question 2 Question 3 Question 4 Question 5

A-1; B-2; C-3 A-3; B-2; C-1 A-2; B-1; C-3 A-1; B-3; C-2 A-1; B-3; C-2

Results

①11-15 points: You’re a perfect consumer! You never think twice if you see something you like. But it’s not healthy for your wallet. Maybe you should learn how to control your spending.

②6-10 points: You’re always trying to control the money while still staying fashionable.

③0-5 points: You never spend money unless you need something. You know how to save money.

21.What should you do if you get 12 points

A.Learn how to control your spending. B.Go shopping as little as possible.

C.Share your shopping skills with others. D.Work hard and make more money.

22.If you always buy something you need, your score may be _________.

A.3 B.6 C.9 D.12

23.Which of the following may be the best title

A.Why does someone like shopping B.Which kind of consumers are you

C.Where do you like shopping D.What scores do you want

Are you good with money Do you get pocket money from your parents or do you work to earn money Read on to find out about British teenagers and their cash! Pocket money

Most teenagers in Britain receive pocket money from their parents. They might have to do chores to get their pocket money. These chores can include cleaning, cooking, washing dishes, and ironing. Part-time work

A part-time job is a choice for teenagers who don’t have pocket money or who want to earn more money. About 15 percent of teenagers have a job. Only children over the age of 13 can work. Popular part-time jobs for teens include babysitting, delivering newspapers, shop work and restaurant work.

Children in Britain can work a maximum of two hours a day on a school day but not during school hours. During weekends and school holidays, they can work longer hours. Bank account

Some children and teenagers have a bank account. There is no legal (法定的) age limit (限制) at which you can open a bank account (账户), but a bank manager can decide whether to open an account for a child or young person. Parents can put pocket money directly into their child’s bank account.

So, many teenagers are becoming a financially (财政上) independent person and earning and looking after your own money.

24.What might most teenagers help their parents with if they want to get pocket money from them

A.Some housework. B.Some homework.

C.Some shopping. D.Some babysitting.

25.What is a good choice for teenagers who want to earn more money

A.Open a bank account. B.Do a part-time job.

C.Save the pocket money. D.Spend money carefully.

26.Jason’s good at cooking. What part-time job will he take if he want to earn more

A.Help in restaurant. B.Be a shop assistant.

C.Deliver the newspaper. D.Send milk to neighbours.

27.What does this passage mainly talk about

A.How to help with the chores. B.How to find a part-time job.

C.How to open a bank account. D.How to earn and save money.

Do we still need cash The days of holding cash in our hands may be numbered. The progress of technology and the development of new electronic devices in the world change how we make payments. With a swipe (刷) of a card or a click of a mobile-phone app, our wealth goes easily at our fingertips. Happiness also arises. As digital forms are increasingly replacing cash payments, some think that we should become fully cash-free. However, I do not believe we should move towards a completely cash-free society.

One of the main problems of a cashless world is the risk of being cheated and the inconvenience (不便) that follows. The digital world is not completely safe. Our present state of technology is unable to provide a safe cashless environment that could stop bad people from entering the system and abusing (滥用) the personal data. Occasionally, when an account (账户) is “locked” because of a wrong activity, having cash in hand becomes important. In a cashless society, a client would find himself locked out of his account and unable to get his money until the case is solved. Going cash-free causes great inconvenience in this case.

Another reason we should not move towards becoming completely cashless is that humans might become less thrifty (节俭的). Many studies have suggested that using cash for shopping causes a psychological (心理的) pain, so people are more careful with their spending. However, payments without cash ease that psychological pain somewhat. In fact, it could make us much more reckless (草率的).

We cannot choose to ignore (忽略) the fact that a large percentage of poor people in the developing world depend on cash to buy everyday goods such as rice and vegetables. Being cashless may not be as beneficial to the poor as it is made out to be.

The idea of society finally going completely cashless is a very real, even an exciting one. However, to safeguard the interests of all users, it is better to build a less-cash society rather than a completely cashless one.

28.When will you most probably feel happier

A.When you buy your favorite shoes with cash in a store.

B.When you click your payment app on your mobile phone.

C.When you pay for your everyday goods such as rice and vegetables.

D.When you get more benefits from cash-free transactions with poor people.

29.What does the underlined word “ease” in Paragraph 3 mean

A.Increase. B.Interest. C.Reduce. D.Stop.

30.What does the writer probably agree

A.Cash-free provides people a more convenient environment.

B.The technology nowadays is safe enough for clients.

C.Cashless society can stop people from abusing the data.

D.We should not move towards a completely cashless society.

31.Which of the following would be the best title of the passage

A.Is Cash-Free Society Coming B.Is Cashless Society Really Free

C.The Benefits of Cash-Free Society. D.Cashless Society Brings us Convenience.

With the development of the mobile Internet and mobile payment (支付), more and more children are not using paper money now.

A report shows 86% of people in China use mobile phones to pay. For students, they seldom touch (触碰) the real money in their daily life. They may only do it when they get lucky money during the Spring Festival. When they need to buy something, they usually don’t reach into their pockets for paper money. They use their digital (电子的) watches. As a result, many children ask their parents, “Why not keep money in the mobile phone or the watch ”

Hearing the question from their kids, a large number of parents start to worry. “Our children don’t have a sense of money. For them, money is just numbers. They have no idea where money comes from or how difficult one makes money. This may cause big problems when they grow up,” one mother said.

To solve the problem, a few primary schools in some cities begin to give special Maths classes to teach students about money. During the lessons, teachers show all the paper money and coins (硬币) to students and teach them the basic units, like yuan, jiao and fen. What’s more, the teachers ask the students to do simple calculations (计算): from jiao to yuan or from yuan to fen. Mr Wang, a head teacher, said, “Most children know little about money, so we need to help them get to know it. It’s a challenging job, but the classes will be helpful to them in the future.”

32.How does the writer start the passage

A.By playing a trick. B.By showing a fact.

C.By asking a question. D.By showing numbers.

33.Now, children usually pay for the things with ________.

A.paper money B.coins C.digital watches D.lucky money

34.What does the underlined word “challenging” mean

A.Boring. B.Interesting. C.Dangerous. D.Difficult.

35.The last paragraph is mainly about ________.

A.how schools help kids learn about money

B.what problems kids meet in Maths classes

C.how Maths teachers give interesting classes

D.why kids don’t often touch real money now

How much pocket money do you get each week How do you spend (花费) it We asked four students about their pocket money and here are their answers.

Hilary: I get $30 from my parents every two weeks. To get it, I have to clean my room, wash clothes and walk our family dog every day. I spend my money on snacks, CDs and hair clips. I love giving presents too. So I save (节省) $5 a week to spend at Christmas.

Jennifer: My pocket money is only $10 a week. Sometimes, I get another $2 if I look after my young brother when my parents go out on Saturday. With the money, I have to pay bus fares (车票), so I walk a lot to save money. People say I am miserly, but I don’t think so. I’m just careful with money (不乱花钱) because $10 a week isn’t enough.

Bill: My parents give me $16 every week. I spend most of it on snacks and books. Now I work in a fruit shop on Saturday mornings. I’m saving money to buy a new bike.

Tim: My pocket money is $ 20 a week. With it I buy food, computer games and sports books. I often buy too many things, so by Wednesday I have no money left. But usually Mum doesn’t give me more money.

36.To get some pocket money, Hilary ________.

A.works in a fruit shop B.washes her dad’s car

C.helps out around her home D.looks after her young brother

37.The underlined word “miserly” probably means “________” in Chinese.

A.吝啬的 B.小心的 C.无聊的 D.与众不同的

38.Bill is saving money to buy ________.

A.some CDs B.a computer game C.a bike D.a Christmas gift

39.Who gets the most pocket money each week

A.Jennifer. B.Bill. C.Hilary. D.Tim.

40.Which of the following is TRUE

A.All of the students spend their pocket money on snacks.

B.Both Tim and Jennifer think their pocket money isn’t enough.

C.Both Hilary and Tim spend their pocket money on CDs.

D.All of the students save some pocket money each week.

▲

Song Qian, 14 I got 3,600 yuan this year. I would like to use this money to buy some books and school supplies (学 习用品). The money will also be useful for after- class activities and study projects.

Zhang Ping, 13 During Spring Festival, I got over 2,000 yuan in gift money. I can decide how to use the money. I chose to put all of it in the bank. I hope to use it if I have a chance to study abroad in the future.

Li Ai,12 The gift money I got this year was over 1,000 yuan. I gave most of it to my parents. They will use the money to pay for some of my school fees. Of course. I still have some left for myself. I am planning to buy gifts for my parents on their birthdays.

Li Lei, 14 I can use part of my gift money. I have 4,800 yuan in the bank this year and I will take out 700 yuan for myself. I will use the money to buy textbooks, snacks and to go to the movies.

41.Song Qian planned to use her gift money to ________.

a. buy her parents gifts b. buy books and school supplies

c. go to see movies d. pay for after-class activities and study projects

A.ab B.ac C.bc D.bd

42.How much money will be left in the bank for Li Lei

A.4800 yuan B.4100 yuan C.2000 yuan D.700 yuan

43.According to the four students, they won’t spend the gift money on ________.

A.study B.travelling C.gifts D.snacks

44.Which of the following sentence can be put on the ▲

A.How do you spend Spring Festival gift money

B.How much Spring Festival gift money do you get

C.Who gives you Spring Festival gift money

D.What will you buy with your Spring Festival gift money

A budget (预算) is a spending plan. It can help you spend money wisely. It can do this by cutting out wasteful spending. Of course, preparing a budget takes planning, and following a budget takes self-control. Your budget should meet your family’s needs and income.

The first step in creating a budget is to set your goals. What does your family need and want You must know this to work out the details of the budget. Keep goals realistic. Then decide which goals are the most important.

The next step is finding out family income. Write down all the money you expect to receive (including wages (工资), savings, interest, etc.) during the planned budget period. Before you can plan wisely, you need to know how much money you have to spend!

After you have calculated how much money will be available, it is time to find out expenses (支出). List all of your family expenses.

If you are not satisfied with what you got for your money, look carefully at your spending. Studying your records will show where overspending has happened. It will also point out poor buying habits.

It is also a good idea to prepare a small amount of money for emergencies (紧急事件). Every family has small emergencies: a blown tire, a broken device, or the need for medical care.

45.According to the passage, what is the advantage of a budget

A.It can help you set your goals clearly. B.It can help you save a lot of money.

C.It can help you get rid of poor buying habits. D.It can help you spend money in a reasonable way.

46.In carrying out your budget, you need ________.

A.to have the ability to control yourself B.to ask your family members for advice

C.to cut it down as much as possible D.to take care not to buy expensive things

47.What does the underlined word “income” in Paragraph 3 mean

A.The money you can spend. B.The money you can get.

C.The money you can save. D.The money you want to make.

48.The writer says that it is a good idea to prepare some money because ________.

A.you probably will not be able to follow your budget

B.people usually spend more than they plan to do

C.things can happen unexpectedly

D.others may want to borrow some money from you

49.What is this passage mainly about

A.The meaning of a budget. B.The relation between budget and income.

C.The way a budget is made. D.The importance of making a budget.

Jenny knew she had a problem when she looked in her money box. It was only three days until the school trip to the beach, and Jenny didn’t have any money. To make things worse, her next pocket money was still six days away.

“What’s the matter, Jenny ” asked her sister, Mary. “Mary,” said Jenny, “I’m in double trouble. I can’t go to the beach with my classmates, and I’ve broken my promise to Mom. I promised I’d stay within my budget (预算) this month.” For a few minutes, the two girls just sat and thought. Then Mary grabbed Jenny’s arm. “Jenny, I won’t give you the money, but I will help you. Just listen for a minute.” At first, Jenny wasn’t interested since Mary wasn’t willing to give her the money she needed. However, after Mary explained her plan, Jenny began to like it. Mary would lend Jenny the money for the beach trip, but Jenny would have to create a real budget for herself and follow it. In addition, if Jenny successfully followed the budget, Mary wouldn’t tell their mother about Jenny’s recent money disaster. “Mary, you are a lifesaver.” Jenny hugged Mary’s neck.

The two sisters began to work together. After several hours, they agreed on how Jenny should use her money. Mary took their figures and made a graph (表格) for Jenny. Holding up the graph, Mary said, “Now you can see where your money should go each month,” “Thanks, Mary.” Jenny said. “But I know one thing that my money can’t buy. It couldn’t buy another great sister like you,” said Jenny. Then she hung her new budget on her bedroom wall.

50.What was Jenny’s problem

A.She had no friends. B.She had nothing to do. C.She had no money. D.She had no free time.

51.How did Mary help Jenny

A.By going to the beach with her. B.By buying things for the school trip for her. C.By telling Mom about her problem. D.By planning on how to use money with her.

52.What can we learn from the passage

A.Practice makes perfect. B.A useful way is better than direct help. C.It’s never too old to learn. D.Imagination is more important than knowledge.

How would you like to pay when you go shopping Cash payment Mobile payment People in China may pay by WeChat on the phones. We don’t use paper money very often.

While WeChat Pay is now a part of life in our country, this way of paying also appears in other countries. A lot of foreign companies and traders have to accept it. According to Xinhua News, about 13 foreign countries have WeChat Pay services for Chinese travellers.

Is it good or bad to use WeChat Pay Will people no longer use paper money in the future Some discussions appear on the Internet.

“I don’t think so. Nearly half of Chinese people live in the countryside. People there can’t enjoy it without good Internet service. And most old people like to use paper money,” said Winnie.

Steven said, “WeChat Pay is convenient and safe. We needn’t tell if the money is real or fake. But paper money is just the opposite. We should encourage people to use WeChat Pay more.”

“For a long time, people will use different payment ways,” said Sunshine. “Traders should allow people to choose the ways they like to pay.”

Will paper money disappear in the future What’s your opinion about it

53.When we pay by WeChat, we need to use our _________.

A.wallets B.phones C.paper money D.ID cards

54.Winnie thinks that _________.

A.WeChat Pay is convenient and safe

B.it is not safe if people don’t use paper money

C.paper money is more popular among old people

D.people in the countryside can use WeChat Pay well

55.The underlined word “fake” in Paragraph 5 may mean “_________”.

A.脏的 B.假的 C.麻烦的 D.残缺的

56.From the passage, we can know _________.

A.only Chinese people use WeChat Pay

B.paper money will surely disappear in the future

C.people use WeChat Pay more than paper money in the world

D.Chinese travellers can use WeChat Pay in about 13 foreign countries

57.What’s the best title for this passage

A.Payment ways in the future

B.WeChat payment in the world

C.Will paper money disappear in the future

D.Why do people use WeChat

Money always flows between people. When money moves from one person to another, it’s known as an exchange or transaction. Here are the main ways it happens.

Earning Most people earn money by doing a job that somebody pays them. Spending People spend money they earn on things they need, such as food and electricity and stuff they want, such as books and treats. Donating Some organizations and charities rely on people giving them money. Giving money to a cause is known as donating.

Taxation People can’t keep all the money they make. Everyone has to give some to the government to help pay for public services, such as schools and hospitals. This is known as taxation. Borrowing and lending When people can’t afford to do something, they can sometimes borrow money from somewhere else, such as a bank. Lent money is known as a loan. All loans have to be paid back. Investing Investing is when someone spends money on something to make more money from it in the end. There are many different ways to invest.

58.Which of the following is “earning”

A.Spending money on clothes. B.Getting money by doing jobs.

C.Offering money to the poor. D.Giving money to the government.

59.You bought a piece of art. Hopefully you can sell it and make some money in the future. What is it called

A.Donating. B.Taxation.

C.Borrowing and lending. D.Investing.

60.What’s the purpose of the passage

A.To help charities raise money. B.To introduce ways money moves.

C.To give instructions to spend money. D.To recommend methods of investing.

试卷第1页,共3页

试卷第1页,共3页

《【考点突破】阅读理解:11 金融和理财 专项练--2025中考英语备考(含答案)》参考答案

题号 1 2 3 4 5 6 7 8 9 10

答案 C C A D B C D B A A

题号 11 12 13 14 15 16 17 18 19 20

答案 B B B B D C B B C D

题号 21 22 23 24 25 26 27 28 29 30

答案 A A B A B A D B C D

题号 31 32 33 34 35 36 37 38 39 40

答案 A B C D A C A C D B

题号 41 42 43 44 45 46 47 48 49 50

答案 D B B A D A B C C C

题号 51 52 53 54 55 56 57 58 59 60

答案 D B B C B D C B D B

1.C 2.C 3.A 4.D 5.B

6.C 7.D 8.B

9.A 10.A 11.B

12.B 13.B 14.B 15.D

16.C 17.B 18.B 19.C 20.D

21.A 22.A 23.B

24.A 25.B 26.A 27.D

28.B 29.C 30.D 31.A

32.B 33.C 34.D 35.A

36.C 37.A 38.C 39.D 40.B

41.D 42.B 43.B 44.A

45.D 46.A 47.B 48.C 49.C

50.C 51.D 52.B

53.B 54.C 55.B 56.D 57.C

58.B 59.D 60.B

答案第1页,共2页

答案第1页,共2页

Learning how to manage money is an important skill for everyone, especially for teenagers. Understanding how to save and spend money can help you make better decisions in the future. Here are some tips on how to manage money.

A budget is a plan that shows how much money you have and how you will spend it.

To create a budget, first you can list all the money you can get, such as pocket money. Then, list all the money you will spend, including food, clothes, books, etc. Make sure you spend less than you can get.

Saving money is important because it helps you prepare for the future. Try to save a part of your money every month. You can save it in a bank account. Saving also helps you build a habit of not spending all your money at once.

Think carefully before you spend your money. Ask yourself if you really need what you are about to buy. It’s easy to spend money on things you don’t need, so think twice before paying. Avoid (避免) impulse buying, which is buying something without planning.

By following these tips, teenagers can learn to manage their money more wisely and better prepare for themselves. The lessons at school should guide the students to practise managing money wisely. But today schools and society had better pay more attention to the topic.

1.What is a budget

A.A plan that tells you how much money you have.

B.A plan that shows how you will spend money.

C.A plan that tells you how much money you have and how you will spend it.

D.A plan for how to spend your money.

2.Why is saving money important

A.It helps you buy more things. B.It allows you to lend money to friends.

C.It prepares you for the future. D.It prevents you from having fun.

3.What should you avoid in order to spend wisely

A.Impulse buying. B.Creating a budget.

C.Saving a part of your money. D.Getting more money.

4.What’s the main idea of the passage

A.How to earn money. B.Money and business.

C.Don’t give your children too much money. D.Money management for teenagers.

5.What does the underlined word “society” mean in Chinese in the last sentence

A.家长 B.社会 C.大众 D.政府

6.What do Peter and Mary spend most of their money on

A.Food. B.Taxes. C.Housing. D.Utilities.

7.Which item is the same percentage (百分比) for Peter and Mary

A.Savings. B.Food. C.Entertainment. D.Insurance.

8.Which of the following statements is TRUE

A.Mary has her own car while Peter doesn’t. B.Peter never saves any money every month.

C.Mary spends less money on food than Peter. D.They spend over 12% of their money on taxes.

Many children first learn the value of money by receiving pocket money. Parents often give their children an amount of money that they may spend as they wish. The aim is to let the children learn from experience at an early age when financial (财务的) mistakes are not very costly.

At first, young children may spend all of their pocket money soon after they receive it. If they do this, they will learn the hard way and then know that spending must be done within a budget. Parents should not offer more money until the next pocket money is given.

Older children may be responsible enough to budget larger costs like those of clothing. The object is to show young people that a budget needs choices between spending and saving.

Many people who have written on the subject say it is not a good idea to pay your child for work around the home. These jobs are a normal part of family life. Paying children to do extra work around the home, however, can be useful. It can even provide an understanding of how a business works.

Pocket money gives children a chance to experience three things they can do with money. They can share it in the form of gifts. They can spend it by buying things they want. Or they can save it.

Saving helps children understand that costly goals require sacrifice (舍弃): you have to cut costs and plan for the future. Requiring children to save part of their pocket money can also open the door to future saving and investing (投资). Many banks offer free savings accounts for young people with small amounts of money.

9.Parents give children pocket money with the aim of ________.

A.letting children learn to deal with money

B.letting children give their pocket money to people in need

C.letting children save more money for their future business

D.letting children spend the pocket money on video games

10.What does the underlined word “It” refer to

A.Paying children for extra work around the home.

B.The housework that children should be paid for.

C.Getting children to do extra work around the home.

D.The amount of money that is paid to children for housework.

11.Which of the following is the writer’s opinion on pocket money

A.Pocket money is given each week or each month by parents.

B.It is necessary for the children to save part of the pocket money.

C.Young children should spend all of their pocket money soon after they receive it.

D.Parents should offer children more money if they spend all soon after they get it.

Every week, Brad’s parents give him $12. It is not a gift. In fact, Brad makes that money himself. Each day, Brad takes out the rubbish, does the dishes and walks the family dog.

The problem is that Brad’s money goes away so quickly. Brad buys hundreds of toys. When he wants to go to the movies with friends, he can never cover a ticket. The money seems to burn a hole (洞) in his pocket.

One day, Brad’s mom says to him, “You should make a budget.”

“What’s that ” asks Brad.

“It’s a plan of how you spend your money. You put the money into different parts for different kinds of things, like toys and snacks. You spend only as much as your budget allows (允许). In that way, you’re sure to have money for different things,” says his dad.

“Sounds great,” says Brad. “Will you help me make one ”

Then, they put the money into different parts for snacks, toys, movies and books. There are also two special parts, one for helping others and the other for Brad’s savings.

From that day on, Brad always has enough money. At the end of the year, he gives away $80 to the old people’s home. Helping those in need makes Brad feel good. He then uses some of his savings to buy a small robot. That makes him feel good, too.

12.Brad makes the money by ________.

A.selling his old toys B.doing housework

C.asking parents for help D.working in a cinema

13.Why does Brad make a budget

A.Because he has too much money.

B.Because he spends money quickly.

C.Because he has a hole in the pocket.

D.Because his pocket is too small for the money.

14.Which is the correct order of the following things

①Brad helps people in need.

②Brad buys a lot of toys.

③Brad puts his money into different parts.

④Brad’s dad tells him what a budget is.

A.①④③② B.②④③① C.②③④① D.④③②①

15.What do we know about Brad’s budget

A.He plans to spend more money on toys.

B.He saves two dollars every week now.

C.He makes the budget without his parents’ help.

D.He gives some money to the old people’s home.

Money is valuable. We use money to buy what we need and want. In today’s society, money plays an important role in our daily lives, making it possible for us to meet our basic needs such as food and clothing, as well as providing chances for entertainment, education and personal growth. That is why we have to choose between things and spend our money wisely. Here is a survey about the monthly spending of two foreign students.

Helen’s and David’s monthly spending

根据短文和图表内容,选择最佳答案。

16.What percent of the money does Helen spend on food

A.50%. B.20%. C.14%. D.18%.

17.What do Helen and David spend the same percentage of money on

A.Others. B.Books. C.Savings. D.Food.

18.What does David pay 20% of his money for

A.Savings. B.Food. C.Books. D.Others.

19.Which of the following does the writer most probably agree with

A.We don’t need to save money. B.Money can buy everything.

C.We should spend our money wisely. D.The more expensive, the better.

20.Where is the passage probably from

A.A storybook. B.A map. C.A music magazine. D.A newspaper.

Try this test to see if you are a typical consumer (典型的消费者) !

1. Are you a fashion (时装) lover Do you go straight to the shops to try the latest styles A.No. Fashion doesn’t interest me. B.I’m interested in fashion but not crazy about it. C. Yes. I always go shopping in order to stay fashionable. 2. If the pair of shoes you like costs over 500 yuan, you’ll _________. A.buy without thinking twice B.think about it and maybe buy later C. forget it; you won’t pay so much for a pair of shoes 3. How do you spend your money A.Save it for later. B.Buy something cultural, like books. C. Go straight to the shops and buy something. 4. Are there any differences between Pepsi and Coca Cola A.No. They are the same. B.Yes, and I only drink one. C. Yes, but I can’t explain the difference. 5. Are you an impulsive (冲动的) consumer A.No, I hardly act without thinking. B.Yes. I love doing things without thinking. C. It depends. Sometimes I am; sometimes I’m not.

Corresponding scores (相应的分数)

Question 1 Question 2 Question 3 Question 4 Question 5

A-1; B-2; C-3 A-3; B-2; C-1 A-2; B-1; C-3 A-1; B-3; C-2 A-1; B-3; C-2

Results

①11-15 points: You’re a perfect consumer! You never think twice if you see something you like. But it’s not healthy for your wallet. Maybe you should learn how to control your spending.

②6-10 points: You’re always trying to control the money while still staying fashionable.

③0-5 points: You never spend money unless you need something. You know how to save money.

21.What should you do if you get 12 points

A.Learn how to control your spending. B.Go shopping as little as possible.

C.Share your shopping skills with others. D.Work hard and make more money.

22.If you always buy something you need, your score may be _________.

A.3 B.6 C.9 D.12

23.Which of the following may be the best title

A.Why does someone like shopping B.Which kind of consumers are you

C.Where do you like shopping D.What scores do you want

Are you good with money Do you get pocket money from your parents or do you work to earn money Read on to find out about British teenagers and their cash! Pocket money

Most teenagers in Britain receive pocket money from their parents. They might have to do chores to get their pocket money. These chores can include cleaning, cooking, washing dishes, and ironing. Part-time work

A part-time job is a choice for teenagers who don’t have pocket money or who want to earn more money. About 15 percent of teenagers have a job. Only children over the age of 13 can work. Popular part-time jobs for teens include babysitting, delivering newspapers, shop work and restaurant work.

Children in Britain can work a maximum of two hours a day on a school day but not during school hours. During weekends and school holidays, they can work longer hours. Bank account

Some children and teenagers have a bank account. There is no legal (法定的) age limit (限制) at which you can open a bank account (账户), but a bank manager can decide whether to open an account for a child or young person. Parents can put pocket money directly into their child’s bank account.

So, many teenagers are becoming a financially (财政上) independent person and earning and looking after your own money.

24.What might most teenagers help their parents with if they want to get pocket money from them

A.Some housework. B.Some homework.

C.Some shopping. D.Some babysitting.

25.What is a good choice for teenagers who want to earn more money

A.Open a bank account. B.Do a part-time job.

C.Save the pocket money. D.Spend money carefully.

26.Jason’s good at cooking. What part-time job will he take if he want to earn more

A.Help in restaurant. B.Be a shop assistant.

C.Deliver the newspaper. D.Send milk to neighbours.

27.What does this passage mainly talk about

A.How to help with the chores. B.How to find a part-time job.

C.How to open a bank account. D.How to earn and save money.

Do we still need cash The days of holding cash in our hands may be numbered. The progress of technology and the development of new electronic devices in the world change how we make payments. With a swipe (刷) of a card or a click of a mobile-phone app, our wealth goes easily at our fingertips. Happiness also arises. As digital forms are increasingly replacing cash payments, some think that we should become fully cash-free. However, I do not believe we should move towards a completely cash-free society.

One of the main problems of a cashless world is the risk of being cheated and the inconvenience (不便) that follows. The digital world is not completely safe. Our present state of technology is unable to provide a safe cashless environment that could stop bad people from entering the system and abusing (滥用) the personal data. Occasionally, when an account (账户) is “locked” because of a wrong activity, having cash in hand becomes important. In a cashless society, a client would find himself locked out of his account and unable to get his money until the case is solved. Going cash-free causes great inconvenience in this case.

Another reason we should not move towards becoming completely cashless is that humans might become less thrifty (节俭的). Many studies have suggested that using cash for shopping causes a psychological (心理的) pain, so people are more careful with their spending. However, payments without cash ease that psychological pain somewhat. In fact, it could make us much more reckless (草率的).

We cannot choose to ignore (忽略) the fact that a large percentage of poor people in the developing world depend on cash to buy everyday goods such as rice and vegetables. Being cashless may not be as beneficial to the poor as it is made out to be.

The idea of society finally going completely cashless is a very real, even an exciting one. However, to safeguard the interests of all users, it is better to build a less-cash society rather than a completely cashless one.

28.When will you most probably feel happier

A.When you buy your favorite shoes with cash in a store.

B.When you click your payment app on your mobile phone.

C.When you pay for your everyday goods such as rice and vegetables.

D.When you get more benefits from cash-free transactions with poor people.

29.What does the underlined word “ease” in Paragraph 3 mean

A.Increase. B.Interest. C.Reduce. D.Stop.

30.What does the writer probably agree

A.Cash-free provides people a more convenient environment.

B.The technology nowadays is safe enough for clients.

C.Cashless society can stop people from abusing the data.

D.We should not move towards a completely cashless society.

31.Which of the following would be the best title of the passage

A.Is Cash-Free Society Coming B.Is Cashless Society Really Free

C.The Benefits of Cash-Free Society. D.Cashless Society Brings us Convenience.

With the development of the mobile Internet and mobile payment (支付), more and more children are not using paper money now.

A report shows 86% of people in China use mobile phones to pay. For students, they seldom touch (触碰) the real money in their daily life. They may only do it when they get lucky money during the Spring Festival. When they need to buy something, they usually don’t reach into their pockets for paper money. They use their digital (电子的) watches. As a result, many children ask their parents, “Why not keep money in the mobile phone or the watch ”

Hearing the question from their kids, a large number of parents start to worry. “Our children don’t have a sense of money. For them, money is just numbers. They have no idea where money comes from or how difficult one makes money. This may cause big problems when they grow up,” one mother said.

To solve the problem, a few primary schools in some cities begin to give special Maths classes to teach students about money. During the lessons, teachers show all the paper money and coins (硬币) to students and teach them the basic units, like yuan, jiao and fen. What’s more, the teachers ask the students to do simple calculations (计算): from jiao to yuan or from yuan to fen. Mr Wang, a head teacher, said, “Most children know little about money, so we need to help them get to know it. It’s a challenging job, but the classes will be helpful to them in the future.”

32.How does the writer start the passage

A.By playing a trick. B.By showing a fact.

C.By asking a question. D.By showing numbers.

33.Now, children usually pay for the things with ________.

A.paper money B.coins C.digital watches D.lucky money

34.What does the underlined word “challenging” mean

A.Boring. B.Interesting. C.Dangerous. D.Difficult.

35.The last paragraph is mainly about ________.

A.how schools help kids learn about money

B.what problems kids meet in Maths classes

C.how Maths teachers give interesting classes

D.why kids don’t often touch real money now

How much pocket money do you get each week How do you spend (花费) it We asked four students about their pocket money and here are their answers.

Hilary: I get $30 from my parents every two weeks. To get it, I have to clean my room, wash clothes and walk our family dog every day. I spend my money on snacks, CDs and hair clips. I love giving presents too. So I save (节省) $5 a week to spend at Christmas.

Jennifer: My pocket money is only $10 a week. Sometimes, I get another $2 if I look after my young brother when my parents go out on Saturday. With the money, I have to pay bus fares (车票), so I walk a lot to save money. People say I am miserly, but I don’t think so. I’m just careful with money (不乱花钱) because $10 a week isn’t enough.

Bill: My parents give me $16 every week. I spend most of it on snacks and books. Now I work in a fruit shop on Saturday mornings. I’m saving money to buy a new bike.

Tim: My pocket money is $ 20 a week. With it I buy food, computer games and sports books. I often buy too many things, so by Wednesday I have no money left. But usually Mum doesn’t give me more money.

36.To get some pocket money, Hilary ________.

A.works in a fruit shop B.washes her dad’s car

C.helps out around her home D.looks after her young brother

37.The underlined word “miserly” probably means “________” in Chinese.

A.吝啬的 B.小心的 C.无聊的 D.与众不同的

38.Bill is saving money to buy ________.

A.some CDs B.a computer game C.a bike D.a Christmas gift

39.Who gets the most pocket money each week

A.Jennifer. B.Bill. C.Hilary. D.Tim.

40.Which of the following is TRUE

A.All of the students spend their pocket money on snacks.

B.Both Tim and Jennifer think their pocket money isn’t enough.

C.Both Hilary and Tim spend their pocket money on CDs.

D.All of the students save some pocket money each week.

▲

Song Qian, 14 I got 3,600 yuan this year. I would like to use this money to buy some books and school supplies (学 习用品). The money will also be useful for after- class activities and study projects.

Zhang Ping, 13 During Spring Festival, I got over 2,000 yuan in gift money. I can decide how to use the money. I chose to put all of it in the bank. I hope to use it if I have a chance to study abroad in the future.

Li Ai,12 The gift money I got this year was over 1,000 yuan. I gave most of it to my parents. They will use the money to pay for some of my school fees. Of course. I still have some left for myself. I am planning to buy gifts for my parents on their birthdays.

Li Lei, 14 I can use part of my gift money. I have 4,800 yuan in the bank this year and I will take out 700 yuan for myself. I will use the money to buy textbooks, snacks and to go to the movies.

41.Song Qian planned to use her gift money to ________.

a. buy her parents gifts b. buy books and school supplies

c. go to see movies d. pay for after-class activities and study projects

A.ab B.ac C.bc D.bd

42.How much money will be left in the bank for Li Lei

A.4800 yuan B.4100 yuan C.2000 yuan D.700 yuan

43.According to the four students, they won’t spend the gift money on ________.

A.study B.travelling C.gifts D.snacks

44.Which of the following sentence can be put on the ▲

A.How do you spend Spring Festival gift money

B.How much Spring Festival gift money do you get

C.Who gives you Spring Festival gift money

D.What will you buy with your Spring Festival gift money

A budget (预算) is a spending plan. It can help you spend money wisely. It can do this by cutting out wasteful spending. Of course, preparing a budget takes planning, and following a budget takes self-control. Your budget should meet your family’s needs and income.

The first step in creating a budget is to set your goals. What does your family need and want You must know this to work out the details of the budget. Keep goals realistic. Then decide which goals are the most important.

The next step is finding out family income. Write down all the money you expect to receive (including wages (工资), savings, interest, etc.) during the planned budget period. Before you can plan wisely, you need to know how much money you have to spend!

After you have calculated how much money will be available, it is time to find out expenses (支出). List all of your family expenses.

If you are not satisfied with what you got for your money, look carefully at your spending. Studying your records will show where overspending has happened. It will also point out poor buying habits.

It is also a good idea to prepare a small amount of money for emergencies (紧急事件). Every family has small emergencies: a blown tire, a broken device, or the need for medical care.

45.According to the passage, what is the advantage of a budget

A.It can help you set your goals clearly. B.It can help you save a lot of money.

C.It can help you get rid of poor buying habits. D.It can help you spend money in a reasonable way.

46.In carrying out your budget, you need ________.

A.to have the ability to control yourself B.to ask your family members for advice

C.to cut it down as much as possible D.to take care not to buy expensive things

47.What does the underlined word “income” in Paragraph 3 mean

A.The money you can spend. B.The money you can get.

C.The money you can save. D.The money you want to make.

48.The writer says that it is a good idea to prepare some money because ________.

A.you probably will not be able to follow your budget

B.people usually spend more than they plan to do

C.things can happen unexpectedly

D.others may want to borrow some money from you

49.What is this passage mainly about

A.The meaning of a budget. B.The relation between budget and income.

C.The way a budget is made. D.The importance of making a budget.

Jenny knew she had a problem when she looked in her money box. It was only three days until the school trip to the beach, and Jenny didn’t have any money. To make things worse, her next pocket money was still six days away.

“What’s the matter, Jenny ” asked her sister, Mary. “Mary,” said Jenny, “I’m in double trouble. I can’t go to the beach with my classmates, and I’ve broken my promise to Mom. I promised I’d stay within my budget (预算) this month.” For a few minutes, the two girls just sat and thought. Then Mary grabbed Jenny’s arm. “Jenny, I won’t give you the money, but I will help you. Just listen for a minute.” At first, Jenny wasn’t interested since Mary wasn’t willing to give her the money she needed. However, after Mary explained her plan, Jenny began to like it. Mary would lend Jenny the money for the beach trip, but Jenny would have to create a real budget for herself and follow it. In addition, if Jenny successfully followed the budget, Mary wouldn’t tell their mother about Jenny’s recent money disaster. “Mary, you are a lifesaver.” Jenny hugged Mary’s neck.

The two sisters began to work together. After several hours, they agreed on how Jenny should use her money. Mary took their figures and made a graph (表格) for Jenny. Holding up the graph, Mary said, “Now you can see where your money should go each month,” “Thanks, Mary.” Jenny said. “But I know one thing that my money can’t buy. It couldn’t buy another great sister like you,” said Jenny. Then she hung her new budget on her bedroom wall.

50.What was Jenny’s problem

A.She had no friends. B.She had nothing to do. C.She had no money. D.She had no free time.

51.How did Mary help Jenny

A.By going to the beach with her. B.By buying things for the school trip for her. C.By telling Mom about her problem. D.By planning on how to use money with her.

52.What can we learn from the passage

A.Practice makes perfect. B.A useful way is better than direct help. C.It’s never too old to learn. D.Imagination is more important than knowledge.

How would you like to pay when you go shopping Cash payment Mobile payment People in China may pay by WeChat on the phones. We don’t use paper money very often.

While WeChat Pay is now a part of life in our country, this way of paying also appears in other countries. A lot of foreign companies and traders have to accept it. According to Xinhua News, about 13 foreign countries have WeChat Pay services for Chinese travellers.

Is it good or bad to use WeChat Pay Will people no longer use paper money in the future Some discussions appear on the Internet.

“I don’t think so. Nearly half of Chinese people live in the countryside. People there can’t enjoy it without good Internet service. And most old people like to use paper money,” said Winnie.

Steven said, “WeChat Pay is convenient and safe. We needn’t tell if the money is real or fake. But paper money is just the opposite. We should encourage people to use WeChat Pay more.”

“For a long time, people will use different payment ways,” said Sunshine. “Traders should allow people to choose the ways they like to pay.”

Will paper money disappear in the future What’s your opinion about it

53.When we pay by WeChat, we need to use our _________.

A.wallets B.phones C.paper money D.ID cards

54.Winnie thinks that _________.

A.WeChat Pay is convenient and safe

B.it is not safe if people don’t use paper money

C.paper money is more popular among old people

D.people in the countryside can use WeChat Pay well

55.The underlined word “fake” in Paragraph 5 may mean “_________”.

A.脏的 B.假的 C.麻烦的 D.残缺的

56.From the passage, we can know _________.

A.only Chinese people use WeChat Pay

B.paper money will surely disappear in the future

C.people use WeChat Pay more than paper money in the world

D.Chinese travellers can use WeChat Pay in about 13 foreign countries

57.What’s the best title for this passage

A.Payment ways in the future

B.WeChat payment in the world

C.Will paper money disappear in the future

D.Why do people use WeChat

Money always flows between people. When money moves from one person to another, it’s known as an exchange or transaction. Here are the main ways it happens.

Earning Most people earn money by doing a job that somebody pays them. Spending People spend money they earn on things they need, such as food and electricity and stuff they want, such as books and treats. Donating Some organizations and charities rely on people giving them money. Giving money to a cause is known as donating.

Taxation People can’t keep all the money they make. Everyone has to give some to the government to help pay for public services, such as schools and hospitals. This is known as taxation. Borrowing and lending When people can’t afford to do something, they can sometimes borrow money from somewhere else, such as a bank. Lent money is known as a loan. All loans have to be paid back. Investing Investing is when someone spends money on something to make more money from it in the end. There are many different ways to invest.

58.Which of the following is “earning”

A.Spending money on clothes. B.Getting money by doing jobs.

C.Offering money to the poor. D.Giving money to the government.

59.You bought a piece of art. Hopefully you can sell it and make some money in the future. What is it called

A.Donating. B.Taxation.

C.Borrowing and lending. D.Investing.

60.What’s the purpose of the passage

A.To help charities raise money. B.To introduce ways money moves.

C.To give instructions to spend money. D.To recommend methods of investing.

试卷第1页,共3页

试卷第1页,共3页

《【考点突破】阅读理解:11 金融和理财 专项练--2025中考英语备考(含答案)》参考答案

题号 1 2 3 4 5 6 7 8 9 10

答案 C C A D B C D B A A

题号 11 12 13 14 15 16 17 18 19 20

答案 B B B B D C B B C D

题号 21 22 23 24 25 26 27 28 29 30

答案 A A B A B A D B C D

题号 31 32 33 34 35 36 37 38 39 40

答案 A B C D A C A C D B

题号 41 42 43 44 45 46 47 48 49 50

答案 D B B A D A B C C C

题号 51 52 53 54 55 56 57 58 59 60

答案 D B B C B D C B D B

1.C 2.C 3.A 4.D 5.B

6.C 7.D 8.B

9.A 10.A 11.B

12.B 13.B 14.B 15.D

16.C 17.B 18.B 19.C 20.D

21.A 22.A 23.B

24.A 25.B 26.A 27.D

28.B 29.C 30.D 31.A

32.B 33.C 34.D 35.A

36.C 37.A 38.C 39.D 40.B

41.D 42.B 43.B 44.A

45.D 46.A 47.B 48.C 49.C

50.C 51.D 52.B

53.B 54.C 55.B 56.D 57.C

58.B 59.D 60.B

答案第1页,共2页

答案第1页,共2页

同课章节目录

- 词法

- 名词

- 动词和动词短语

- 动词语态

- 动词时态

- 助动词和情态动词

- 非谓语动词

- 冠词

- 代词

- 数词和量词

- 形容词副词及其比较等级

- 介词和介词短语

- 连词和感叹词

- 构词法

- 相似、相近词比较

- 句法

- 陈述句

- 一般疑问句和否定疑问句

- 特殊疑问句及选择疑问句

- 反意疑问句

- 存在句(There be句型)

- 宾语从句

- 定语从句

- 状语从句

- 主谓一致问题

- 简单句

- 并列句

- 复合句

- 主谓一致

- 主、表语从句

- 名词性从句

- 直接引语和间接引语

- 虚拟语气

- 感叹句

- 强调句

- 倒装句

- 祈使句

- 句子的成分

- 句子的分类

- 题型专区

- 单项选择部分

- 易错题

- 完形填空

- 阅读理解

- 词汇练习

- 听说训练

- 句型转换

- 补全对话

- 短文改错

- 翻译

- 书面表达

- 任务型阅读

- 语法填空

- 其他资料