book1职高lesson39(浙江省温州市平阳县)

文档属性

| 名称 | book1职高lesson39(浙江省温州市平阳县) |

|

|

| 格式 | rar | ||

| 文件大小 | 1.5MB | ||

| 资源类型 | 教案 | ||

| 版本资源 | 通用版 | ||

| 科目 | 英语 | ||

| 更新时间 | 2007-12-14 00:00:00 | ||

图片预览

文档简介

课件25张PPT。Unit8 Lesson31 Speaking

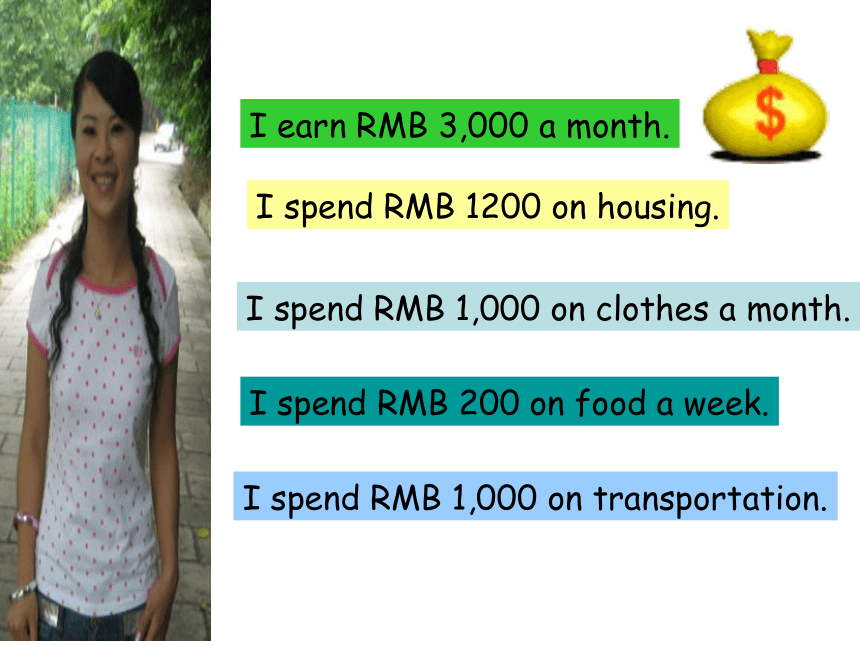

I earn RMB 3,000 a month.How much do you earn every month?

What’s your income(收入)?I like big houses. I rent an apartment for RMB 1,200 a month.How much do you spend on housing?I like expensive clothes.

I spend RMB 1,000 on clothes

a month.How much do you spend on

clothes every month?I like to go to expensive restaurants. I spend RMB 200 on food a week.How much do you spend on food a week?I spend RMB 1,000 on transportation a month.

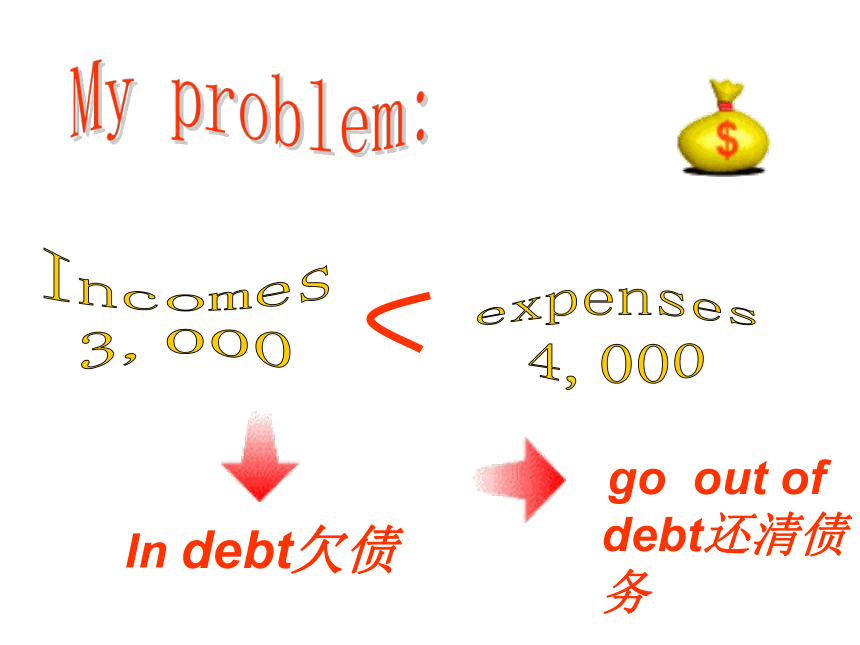

I travel a lot.How much do you spend on transportation a month?I earn RMB 3,000 a month.I spend RMB 1200 on housing.I spend RMB 1,000 on clothes a month.I spend RMB 200 on food a week.I spend RMB 1,000 on transportation.In debt欠债Incomes

3,000 go out of debt还清债务expenses

4,000My problem:Listen and answerWho has some money problems?

A Susan Anderson B Henry William

Money management advisor

理财顾问How much do Henry and his wife earn every month?

A $300 B $3,000 C $1,300

How much do they spend on housing?

A $1,800 B $8,000 C $180Listen and answer

You really need to _____________________.

Don’t spend more than __________of your income on rent.

I think you need to think more about

__________.Read and answerHow does Susan help him to make a budget?find a cheaper place to live in35 percentsaving money预算I earn RMB 3,000 a month.I spend RMB 1200 on housing.I spend RMB 1,000 on clothes a month.I spend RMB 200 on food a week.I spend RMB 1,000 on transportation.I'm in debt.What should

I do?Please help me to make a budget:You need to------

You’d better-----

I think you should------

The cost of clothing ,traveling and food should be 20% of your income.My Budget20%20%20%10%30%Housing Saving Clothing Other

(food, travel,

Health)Transportation I spend 20% of my income on

clothing a month.Speaker A: You are an accountant. You earn $2,000 a month.

But you spend more money than you earn. You live in a big house

travel a lot and go to KTV a lot. You find you’re in debt.Speaker B: You are A’s money management advisor. Give some advice to A and tell A how to make a budget.Your BudgetAsk about incomes/expensesHow much do you earn every month?

What incomes do you have?

How much do you spend on--------?Make a budgetYou need to------

You’d better-----

I think you should------

The cost of clothing ,traveling and food should be 20% of your income.Suggested expressions:

测试你的理财盲点出国旅行,购物是一项很重要的行程。

尤其是跳蚤市场,不但价格极有弹性,

还可以挖到不少宝贝,回国后可能价

位会翻好几倍,你对下列哪一项宝物

最感兴趣? A:古董相机 B:手工织毯 C:古银首饰 D:书画艺品 A:你对于钱财的运用没有什么

观念,开源和节流两种工作,你

宁可只做前者。认为花钱就是要

让自己开心的你,自然不会愿意

委屈自己。吃好的,住好的。用

好的,每一件物品你都觉得花得

很值得。所以你可以试着去投资,因为品位很不错,能够选到可以增值的物品,那么你的收藏癖好,就不再只是让你花大钱,还能有一点回收价值。

B:你的情感丰富,耳根子软,对人毫无防备之心。

你对于推销员的话会照单全收,所以每次出门总是令

家人为你提心吊胆,生怕将所有家产都典当,还不

够支付你信用卡帐单。因为你是感性消费,支出数

目有高有低,最好是先编列预算,控制自己的花费,

才可能挽救你的赤字。 C:你对于每一分钱都很重视,认为财富就

是靠这样一点一滴积累起来的,当然不能小

觑。虽然你从各方面都可以省下一些钱,为

数也很可观,可是这样的速度还是嫌慢,而

且趋于保守,没办法有效率管理钱财。如果

有一笔暂时不需动用的存款,就试着去做一

些投资,结果会让你满意的。 D:你有一点不切实际,做什么

都只为了完成梦想,一点儿都没

有做现实的考虑。对于理财,你

也觉得十分头痛,不知该怎么开

始做起,也不愿卷入股票游戏中,

终日对着数字荧幕发呆。所以你

就这么拖着,虽然知道要留意相

关消息,还是很被动。最好能够

找个可信赖的人,帮你打点这一

切,那是最理想的状况。 Time is money .( Benjamin Franklin , American president) 时间就是金钱。(美国总统 富兰克林. B.) Happiness lies not in the mere possession of money ;

it lies in the joy of achievement , in the thrill of

creative effort .(Franklin Roosevelt , American

president ) 幸福不在于拥有金钱,而在于获得成就时的喜悦以

及产生创造力的激情。(美国总统 罗斯福. F.) Homework2.Ask your parents family’s incomes and expenses.Write down the dialogue you made

in class on your exercise book.3. Preview Lesson 32.Thank you!

Bye bye!

I earn RMB 3,000 a month.How much do you earn every month?

What’s your income(收入)?I like big houses. I rent an apartment for RMB 1,200 a month.How much do you spend on housing?I like expensive clothes.

I spend RMB 1,000 on clothes

a month.How much do you spend on

clothes every month?I like to go to expensive restaurants. I spend RMB 200 on food a week.How much do you spend on food a week?I spend RMB 1,000 on transportation a month.

I travel a lot.How much do you spend on transportation a month?I earn RMB 3,000 a month.I spend RMB 1200 on housing.I spend RMB 1,000 on clothes a month.I spend RMB 200 on food a week.I spend RMB 1,000 on transportation.In debt欠债Incomes

3,000 go out of debt还清债务expenses

4,000My problem:Listen and answerWho has some money problems?

A Susan Anderson B Henry William

Money management advisor

理财顾问How much do Henry and his wife earn every month?

A $300 B $3,000 C $1,300

How much do they spend on housing?

A $1,800 B $8,000 C $180Listen and answer

You really need to _____________________.

Don’t spend more than __________of your income on rent.

I think you need to think more about

__________.Read and answerHow does Susan help him to make a budget?find a cheaper place to live in35 percentsaving money预算I earn RMB 3,000 a month.I spend RMB 1200 on housing.I spend RMB 1,000 on clothes a month.I spend RMB 200 on food a week.I spend RMB 1,000 on transportation.I'm in debt.What should

I do?Please help me to make a budget:You need to------

You’d better-----

I think you should------

The cost of clothing ,traveling and food should be 20% of your income.My Budget20%20%20%10%30%Housing Saving Clothing Other

(food, travel,

Health)Transportation I spend 20% of my income on

clothing a month.Speaker A: You are an accountant. You earn $2,000 a month.

But you spend more money than you earn. You live in a big house

travel a lot and go to KTV a lot. You find you’re in debt.Speaker B: You are A’s money management advisor. Give some advice to A and tell A how to make a budget.Your BudgetAsk about incomes/expensesHow much do you earn every month?

What incomes do you have?

How much do you spend on--------?Make a budgetYou need to------

You’d better-----

I think you should------

The cost of clothing ,traveling and food should be 20% of your income.Suggested expressions:

测试你的理财盲点出国旅行,购物是一项很重要的行程。

尤其是跳蚤市场,不但价格极有弹性,

还可以挖到不少宝贝,回国后可能价

位会翻好几倍,你对下列哪一项宝物

最感兴趣? A:古董相机 B:手工织毯 C:古银首饰 D:书画艺品 A:你对于钱财的运用没有什么

观念,开源和节流两种工作,你

宁可只做前者。认为花钱就是要

让自己开心的你,自然不会愿意

委屈自己。吃好的,住好的。用

好的,每一件物品你都觉得花得

很值得。所以你可以试着去投资,因为品位很不错,能够选到可以增值的物品,那么你的收藏癖好,就不再只是让你花大钱,还能有一点回收价值。

B:你的情感丰富,耳根子软,对人毫无防备之心。

你对于推销员的话会照单全收,所以每次出门总是令

家人为你提心吊胆,生怕将所有家产都典当,还不

够支付你信用卡帐单。因为你是感性消费,支出数

目有高有低,最好是先编列预算,控制自己的花费,

才可能挽救你的赤字。 C:你对于每一分钱都很重视,认为财富就

是靠这样一点一滴积累起来的,当然不能小

觑。虽然你从各方面都可以省下一些钱,为

数也很可观,可是这样的速度还是嫌慢,而

且趋于保守,没办法有效率管理钱财。如果

有一笔暂时不需动用的存款,就试着去做一

些投资,结果会让你满意的。 D:你有一点不切实际,做什么

都只为了完成梦想,一点儿都没

有做现实的考虑。对于理财,你

也觉得十分头痛,不知该怎么开

始做起,也不愿卷入股票游戏中,

终日对着数字荧幕发呆。所以你

就这么拖着,虽然知道要留意相

关消息,还是很被动。最好能够

找个可信赖的人,帮你打点这一

切,那是最理想的状况。 Time is money .( Benjamin Franklin , American president) 时间就是金钱。(美国总统 富兰克林. B.) Happiness lies not in the mere possession of money ;

it lies in the joy of achievement , in the thrill of

creative effort .(Franklin Roosevelt , American

president ) 幸福不在于拥有金钱,而在于获得成就时的喜悦以

及产生创造力的激情。(美国总统 罗斯福. F.) Homework2.Ask your parents family’s incomes and expenses.Write down the dialogue you made

in class on your exercise book.3. Preview Lesson 32.Thank you!

Bye bye!